Aaron Carroll over at the blog The Incidental Economist (see here) investigates the often made assertion that "doctors are refusing Medicare and Medicaid patients." Using data from a new study published in the Archives of Internal Medicine, Mr. Carroll shows there is much more to the story. He says the study shows that:

First that the difference in the rates of acceptance of new patients with Medicare, private non-capitated patients, and self-pay patients are pretty similar. If you want to get detailed, however, the acceptance rate of private non-capitated patients went down more than the other two groups. Second, Medicaid acceptance rates were lower. They were comparable, however, to the acceptance rate of patients in private capitated plans. Also, not much changed from 2005-2008.

"God can have opinions; everyone else should bring some data." often attributed to W. Edwards Deming, but most likely should be attributed to R. A. Fisher or George Box

Tuesday, June 28, 2011

Is "cheap labor" winding down in China?

Bill Powell at Time Magazine has an interesting article about the era of "cheap labor" in China. The article quotes Helen Qiao, chief economist for Goldman Sachs in Hong Kong, saying "real wages for manufacturing workers in China have grown nearly 12% per year." However, the article states that the average manufacturing wage in China is still just $3.10 per hour (compared to about $22 in the U.S.).

Bruce Bartlett on who doesn't pay income taxes

Bruce Bartlett has a very interesting piece over at Economix about who doesn't pay income taxes. Mr. Bartlett says:

During the 1990s, about 24 percent of filers had no income tax liability, but this number took a big jump during the George W. Bush administration as Republicans added a large child credit to the tax code. The percentage of filers with no income tax liability rose to 36.3 percent in 2008, from 25.2 percent in 2000.

Then he comments on new 2011 data from the Tax Policy Center (see here) that shows most filers in the bottom quintile of the income distribution (people with incomes below $16,812) do not pay federal income taxes, but, interestingly enough, there are significant numbers of filers in the upper income distribution (for example, with incomes above $211,000) that did not pay federal income taxes either. The table (again, here) from the Tax Policy Center is given below (click on table to enlarge).

Mr. Bartlett does as much as anybody I know to bring empirical data to the opinion dominated discussion of taxes.

During the 1990s, about 24 percent of filers had no income tax liability, but this number took a big jump during the George W. Bush administration as Republicans added a large child credit to the tax code. The percentage of filers with no income tax liability rose to 36.3 percent in 2008, from 25.2 percent in 2000.

Then he comments on new 2011 data from the Tax Policy Center (see here) that shows most filers in the bottom quintile of the income distribution (people with incomes below $16,812) do not pay federal income taxes, but, interestingly enough, there are significant numbers of filers in the upper income distribution (for example, with incomes above $211,000) that did not pay federal income taxes either. The table (again, here) from the Tax Policy Center is given below (click on table to enlarge).

Mr. Bartlett does as much as anybody I know to bring empirical data to the opinion dominated discussion of taxes.

What about my investment portfolio?

A post over at The Capital Spectator blog seems to have some good advice as we consider what to do with our investment portfolios (for most, people, their retirement money) in this confusing economy.

In any case, it all comes back to your portfolio’s mix. The world is teeming with investment advice. Some of it may actually be useful. But before you do anything, analyze your portfolio and recognize how your asset allocation has changed. If it’s more or less where you want it to be, it may be reasonable to leave your portfolio as is, even if the seers are telling you that it’s time to act.

In any case, it all comes back to your portfolio’s mix. The world is teeming with investment advice. Some of it may actually be useful. But before you do anything, analyze your portfolio and recognize how your asset allocation has changed. If it’s more or less where you want it to be, it may be reasonable to leave your portfolio as is, even if the seers are telling you that it’s time to act.

Monday, June 27, 2011

2010 and 2011 ranking of top "vehicles made in America" .... surprise

CARPE DIEM (see here) has a table of the top ten best-selling vehicles "made in America." The top two are the Toyota Camry (made in Georgetown, KY and Lafayette, IN) and the Honda Accord (made in Marysville, OH and Lincoln, AL).

Lawyers everywhere .... almost

Catherine Rampell over at Economix (see here) has a piece today about the surplus of lawyers in the U.S. She references a model developed by EMSI (see here) that provides a state by state estimate of the lawyer surplus or shortage. EMSI also estimates the median hourly wage for lawyers by state. According to the model by EMSI, only Nebraska, Wisconsin, and Washington D.C. have lawyer shortages. All other states have a lawyer surplus. New York is estimated to have a surplus of 7,687 (the largest surplus). Mississippi is estimated to have a surplus of 95 lawyers. Below is a graph from EMSI showing the states with the largest estimated lawyer surpluses (click on graph to enlarge).

Fed official speaks about too much leverage

In a speech today entitled "Re-thinking Leverage Subsidies," Narayana Kocherlakota, the President of the Federal Reserve Bank of Minneapolis, (see here) argues three points:

- First, the sharp and largely unanticipated fall in U.S. residential land prices after 2006 was the main cause of the financial crisis of 2007-09.

- Second, household and financial institution leverage exacerbate the sensitivity of the financial system to declines in land prices and so reduce financial stability.

- Third, the U.S. tax system promotes leverage on the part of households and financial institutions.

Mortgage interest deduction by state at Tax Policy blog

Nick Kasprak over at the Tax Policy Blog (here) has a map of the mortgage interest deduction by state (2009 data). The map shows the percentage of returns claiming mortgage interest deductions. Mississippi is listed in the "bottom ten states" with 17.7% (ranked 47th) of the returns for 2009 claiming a mortgage interest deduction. States in the "top ten" saw over 30% of the 2009 returns claim a mortgage interest deduction.

Sunday, June 26, 2011

Data from the Dartmouth Atlas of Health Care

The Dartmouth Atlas of Health Care (see here) has a report for the year 2007 that calculates the "percent of decedents seeing 10 or more physicians during the last six months of life." The data may be downloaded for specific areas of a state. Below are the areas listed for Mississippi (and the percent of decedents in that area that saw 10 or more physicians during the last six months of life).

The report states that:

The study population includes beneficiaries with one of nine chronic conditions who were enrolled in traditional (fee-for-service) Medicare and died during the measurement period.

The report states that:

The study population includes beneficiaries with one of nine chronic conditions who were enrolled in traditional (fee-for-service) Medicare and died during the measurement period.

Saturday, June 25, 2011

More from Jared Bernstein on income inequality

Jared Bernstein has been digging in to the issue of income inequality recently (see here) and what he finds isn't pretty. The table below is from his recent post on this subject (click to enlarge). As I have posted before, income inequality is relatively common in modern capitalist economies. But the growth of income inequality in the U.S. over the last 30 years is troubling. As Mr. Bernstein says:

Back in 1979, the average income of the top 1% was about 33 times that of the bottom fifth. In 2007, that ratio had grown to 100. The real income of middle-class households grew 19% over these years, less than 1% per year, while that of the top 5% grew by about 150% and the top 1%, by 240%.

Back in 1979, the average income of the top 1% was about 33 times that of the bottom fifth. In 2007, that ratio had grown to 100. The real income of middle-class households grew 19% over these years, less than 1% per year, while that of the top 5% grew by about 150% and the top 1%, by 240%.

Are either Republicans or Democrats really serious about the deficit

In the Congressional Budget Office's (CBO) latest deficit projections (federal debt held by the public) as a percent of GDP (report is here), two scenarios are considered. Extended-Baseline Scenario where all tax cuts are allowed to expire (Bush and Obama tax cuts) and Alternative Fiscal Scenario where expiring tax cuts are permanently extended. The graph illustrating this is given below (click on it to enlarge).

The graph clearly shows what happens if tax cuts are left unaddressed. Data like this leads me to wonder if anyone is really serious about cutting the deficit. The Incidental Economist (see here) has a very vivid graph (federal revenue and spending as a percent of GDP) that describes what happens under the Alternative Fiscal Scenario (see below, click to enlarge).

As the Incidental Economist points out, note how little Social Security matters in the long run. Again, are either Republicans and Democrats serious about the deficit? Are citizens? My point is, we can tell when people get serious by observing that they begin to address the issue in a way that has real consequences. Thus far, it appears to me to be little more than ideological ranting. It is time to "come clean" and craft approaches that respect the data.

The graph clearly shows what happens if tax cuts are left unaddressed. Data like this leads me to wonder if anyone is really serious about cutting the deficit. The Incidental Economist (see here) has a very vivid graph (federal revenue and spending as a percent of GDP) that describes what happens under the Alternative Fiscal Scenario (see below, click to enlarge).

As the Incidental Economist points out, note how little Social Security matters in the long run. Again, are either Republicans and Democrats serious about the deficit? Are citizens? My point is, we can tell when people get serious by observing that they begin to address the issue in a way that has real consequences. Thus far, it appears to me to be little more than ideological ranting. It is time to "come clean" and craft approaches that respect the data.

Yes, it appears that teaching can be a long day

Phil Izzo over at the Wall Street Journal has a piece today about the number of hours per year that teachers spend on instruction. In the current climate where bashing public school teachers appears to be acceptable, the results will surprise you. Guess which country's teachers spend the most time on instruction? The graph below is from the article.

Robert Frank on jobs and the deficit

Robert Frank has a post over at the New York Times that puts the issue of jobs and the deficit in clear focus. Speaking about the millions of Americans who are unemployed or under-employed, he says:

If the economy could generate jobs at the median wage for even half of these people, national income would grow by more than 10 times the total interest cost of the 2011 deficit (which was less than $40 billion). So anyone who says that reducing the deficit is more urgent than reducing unemployment is saying, in effect, that we should burn hundreds of billions of dollars worth of goods and services in a national bonfire.

If the economy could generate jobs at the median wage for even half of these people, national income would grow by more than 10 times the total interest cost of the 2011 deficit (which was less than $40 billion). So anyone who says that reducing the deficit is more urgent than reducing unemployment is saying, in effect, that we should burn hundreds of billions of dollars worth of goods and services in a national bonfire.

Friday, June 24, 2011

Ezra Klein on "Inside Job" and the financial crisis

Ezra Klein has a piece over at The Washington Post about the film "Inside Job" that is worth reading. Mr. Klein says "Inside Job" is a good documentary if you don't want to understand what happened. He says:

Watching it, you’d think that the only people who missed the meltdown were corrupt fools, and the way to spot the next one is to have fewer corrupt fools. But that’s not true. Worse, it’s dangerously untrue.

He continues by pointing out that "Inside Job" is similar to the book The Big Short by Michael Lewis. It is interesting and entertaining, but it doesn't get it right. The financial crisis didn't occur simply because of a group of "bad actors." (See my previous post about Paul Krugman and Robin Wells.) Let me give Mr. Klein the well-earned last word here.

What’s remarkable about the financial crisis isn’t just how many people got it wrong, but how many people who got it wrong had an incentive to get it right. Journalists. Hedge funds. Independent investors. Academics. Regulators. Even traders, many of whom had most of their money tied up in their soon-to-be-worthless firms. “Inside Job” is perhaps strongest in detailing the conflicts of interest that various people had when it came to the financial sector, but the reason those ties were “conflicts” was that they also had substantial reasons — fame, fortune, acclaim, job security, etc. — to get it right.

Watching it, you’d think that the only people who missed the meltdown were corrupt fools, and the way to spot the next one is to have fewer corrupt fools. But that’s not true. Worse, it’s dangerously untrue.

He continues by pointing out that "Inside Job" is similar to the book The Big Short by Michael Lewis. It is interesting and entertaining, but it doesn't get it right. The financial crisis didn't occur simply because of a group of "bad actors." (See my previous post about Paul Krugman and Robin Wells.) Let me give Mr. Klein the well-earned last word here.

What’s remarkable about the financial crisis isn’t just how many people got it wrong, but how many people who got it wrong had an incentive to get it right. Journalists. Hedge funds. Independent investors. Academics. Regulators. Even traders, many of whom had most of their money tied up in their soon-to-be-worthless firms. “Inside Job” is perhaps strongest in detailing the conflicts of interest that various people had when it came to the financial sector, but the reason those ties were “conflicts” was that they also had substantial reasons — fame, fortune, acclaim, job security, etc. — to get it right.

The age of greed ... continues

Paul Krugman and Robin Wells have an enlightening review (at the New York Review of Books) of Jeff Madrick's new book Age of Greed: The Triumph of Finance and the Decline of America, 1970 to the Present. Below is a very telling paragraph from their review:

The great financial crisis of 2008–2009, whose consequences still blight our economy, is sometimes portrayed as a “black swan” or a “100-year flood”—that is, as an extraordinary event that nobody could have predicted. But it was, in fact, just the most recent installment in a recurrent pattern of financial overreach, taxpayer bailout, and subsequent Wall Street ingratitude. And all indications are that the pattern is set to continue.

In general, I don't think most people have a sense of just how much hasn't changed. It is simply incorrect - not supported by the facts - to portray this recession as an anomaly caused by .... (pick your favorite target). It was to a great degree the result of "business as usual."

The Madrick book sounds like a good reminder for us all.

The great financial crisis of 2008–2009, whose consequences still blight our economy, is sometimes portrayed as a “black swan” or a “100-year flood”—that is, as an extraordinary event that nobody could have predicted. But it was, in fact, just the most recent installment in a recurrent pattern of financial overreach, taxpayer bailout, and subsequent Wall Street ingratitude. And all indications are that the pattern is set to continue.

In general, I don't think most people have a sense of just how much hasn't changed. It is simply incorrect - not supported by the facts - to portray this recession as an anomaly caused by .... (pick your favorite target). It was to a great degree the result of "business as usual."

The Madrick book sounds like a good reminder for us all.

Working poor in Mississippi increase in 2009

Quess who else is on Facebook?

Rich Harris over at ZDNet is reporting the following:

You now have another reason to check your privacy settings. According to the U.S. Federal Trade Commission, Social Intelligence Corp, has been given the legal thumbs up to archive seven years worth of your Facebook posts. These archives will be used by SIC (oh the applicability of the acronym) as part of their background checking service for job applicants.

I don't see this as a good thing.

You now have another reason to check your privacy settings. According to the U.S. Federal Trade Commission, Social Intelligence Corp, has been given the legal thumbs up to archive seven years worth of your Facebook posts. These archives will be used by SIC (oh the applicability of the acronym) as part of their background checking service for job applicants.

I don't see this as a good thing.

Health care questions for Boomers

Catey Hill over at the Smart Money blogs has an interesting piece entitled "4 Health-Care Questions Every Boomer Needs to Ask." According to her, the questions are:

1. How much money will I need each year for health care?

2. How long will I need these funds?

3. Will my savings and investments deliver enough of a return to pay for health care?

4. Should I buy a long-term care policy?

Her answers are worth reading.

1. How much money will I need each year for health care?

2. How long will I need these funds?

3. Will my savings and investments deliver enough of a return to pay for health care?

4. Should I buy a long-term care policy?

Her answers are worth reading.

Thursday, June 23, 2011

Saving for retirement

Alice Munnell (Director of the Center for Retirement Research at Boston College) has a piece (June 20th) at The Wall Street Journal about how much we are actually saving for retirement with our 401(k)s. So, how are we doing? To answer this question, she reviews a simulation to predict an accumulated value and 2007 data from the Federal Reserve's "Survey of Consumer Finances." Her findings:

In fact, the typical individual approaching retirement had only $78,000, far short of the simulated amount. (Note that the reported amounts include holdings in Individual Retirement Accounts (IRAs) because these balances consist mostly of rollovers from 401(k) plans.) Moreover, those at younger ages do not appear to be on track in their accumulations either.

In fact, the typical individual approaching retirement had only $78,000, far short of the simulated amount. (Note that the reported amounts include holdings in Individual Retirement Accounts (IRAs) because these balances consist mostly of rollovers from 401(k) plans.) Moreover, those at younger ages do not appear to be on track in their accumulations either.

Americans increasingly choose leisure

Joe Light over at The Wall Street Journal has a piece about the 2010 American Time Use Survey released on Wednesday by the Bureau of Labor Statistics (summary here). He says that Americans are gaining more free time and:

According to the survey, that time has been allocated largely to leisure activities and sleep. In 2010, for example, Americans spent an average two hours and 31 minutes watching television on weekdays, up 5.4 minutes from 2007. They caught eight hours and 23 minutes of shut-eye per day, up more than five minutes from 2007.

According to the survey, that time has been allocated largely to leisure activities and sleep. In 2010, for example, Americans spent an average two hours and 31 minutes watching television on weekdays, up 5.4 minutes from 2007. They caught eight hours and 23 minutes of shut-eye per day, up more than five minutes from 2007.

First time claims for unemployment rise to 429,000

The Department of Labor is reporting today that "seasonally adjusted initial claims was 429,000, an increase of 9,000 from the previous week's revised figure of 420,000." The four week moving average was unchanged at 426,250.

Wednesday, June 22, 2011

Jared Bernstein on middle-class incomes and productivity growth

Jared Bernstein has an interesting post over at his blog on why middle-class incomes stopped tracking productivity growth. He says:

The diminished ability to bargain for their fair share of productivity growth is a major factor in the productivity/income split. You may think I’m talking unions here, but I’m not. I’m talking high unemployment.

He shows that from 1947 to 1979, real median family income grew at about the same rate as productivity. However, between 1979 and 2009, productivity grew at a much faster pace than real median family income. He argues that real median family income and productivity stopped tracking between 1979 and 2009 due to "weak job markets, high unemployment, jobless recoveries, and therefore much diminished bargaining power for middle- and lower-income workers".

He is always interesting to read.

The diminished ability to bargain for their fair share of productivity growth is a major factor in the productivity/income split. You may think I’m talking unions here, but I’m not. I’m talking high unemployment.

He shows that from 1947 to 1979, real median family income grew at about the same rate as productivity. However, between 1979 and 2009, productivity grew at a much faster pace than real median family income. He argues that real median family income and productivity stopped tracking between 1979 and 2009 due to "weak job markets, high unemployment, jobless recoveries, and therefore much diminished bargaining power for middle- and lower-income workers".

He is always interesting to read.

William Gross of PIMCO on college, jobs, and congress

William Gross of PIMCO (surely one of the most respected investors around) has some strong words about college, jobs, and especially congress in his new (July 2011, click here) Investment Outlook message to clients. About college students, he says:

The average college graduate now leaves school with $24,000 of debt and total student loans now exceed this nation’s credit card debt at $1.0 trillion and counting (7% of our national debt). ... Students, however, can no longer assume that a four year degree will be the golden ticket to a good job in a global economy that cares little for their social networking skills and more about what their labor is worth on the global marketplace.

And for congress, he says:

Solutions from policymakers on the right or left, however, seem focused almost exclusively on rectifying or reducing our budget deficit as a panacea. While Democrats favor tax increases and mild adjustments to entitlements, Republicans pound the table for trillions of dollars of spending cuts and an axing of Obamacare. Both, however, somewhat mystifyingly, believe that balancing the budget will magically produce 20 million jobs over the next 10 years. ... Both parties, in fact, are moving to anti-Keynesian policy orientations, which deny additional stimulus and make rather awkward and unsubstantiated claims that if you balance the budget, “they will come.” ... The “golden” days are over, and it’s time our school and jobs “daze” comes to an end to be replaced by programs that do more than mimic failed establishment policies favoring Wall as opposed to Main Street.

Well, Mr. Grossman has never been afraid to speak his mind.

The average college graduate now leaves school with $24,000 of debt and total student loans now exceed this nation’s credit card debt at $1.0 trillion and counting (7% of our national debt). ... Students, however, can no longer assume that a four year degree will be the golden ticket to a good job in a global economy that cares little for their social networking skills and more about what their labor is worth on the global marketplace.

And for congress, he says:

Solutions from policymakers on the right or left, however, seem focused almost exclusively on rectifying or reducing our budget deficit as a panacea. While Democrats favor tax increases and mild adjustments to entitlements, Republicans pound the table for trillions of dollars of spending cuts and an axing of Obamacare. Both, however, somewhat mystifyingly, believe that balancing the budget will magically produce 20 million jobs over the next 10 years. ... Both parties, in fact, are moving to anti-Keynesian policy orientations, which deny additional stimulus and make rather awkward and unsubstantiated claims that if you balance the budget, “they will come.” ... The “golden” days are over, and it’s time our school and jobs “daze” comes to an end to be replaced by programs that do more than mimic failed establishment policies favoring Wall as opposed to Main Street.

Well, Mr. Grossman has never been afraid to speak his mind.

BEA releases estimates of state personal income for 1st quarter 2011

The Bureau of Economic Analysis (click here) reports today that:

State personal income growth accelerated to 1.8 percent in the first quarter of 2011, from 0.8 percent in the fourth quarter of 2010 ...

Mississippi experienced a 2.2% improvement in personal income (4th quarter 2010 to 1st quarter 2011), the largest percentage increase in the Southeast and the seventh largest percentage increase overall. However, the BEA notes the following:

A two-percentage point reduction in the personal contribution rate for social security accounted for most of the acceleration in first-quarter personal income growth in most states. The reduction in the contribution rate for social security is one of the provisions of the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010.

State personal income growth accelerated to 1.8 percent in the first quarter of 2011, from 0.8 percent in the fourth quarter of 2010 ...

Mississippi experienced a 2.2% improvement in personal income (4th quarter 2010 to 1st quarter 2011), the largest percentage increase in the Southeast and the seventh largest percentage increase overall. However, the BEA notes the following:

A two-percentage point reduction in the personal contribution rate for social security accounted for most of the acceleration in first-quarter personal income growth in most states. The reduction in the contribution rate for social security is one of the provisions of the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010.

Tuesday, June 21, 2011

Crazy college courses

Karlee Weinmann over at The Fiscal Times is having some fun (click here) with "10 Crazy College Classes that Cost Big Bucks." These are real college classes. Example: "Lady Gaga and the Sociology of Fame," University of South Carolina ($1,200 in-state tuition, $3,150 out-of-state).

More seriously, she says:

But students today often aren’t very interested in those more traditional offerings, says Mark Bauerlein, an English professor at Emory who wrote The Dumbest Generation: How the Digital Age Stupefies Young Americans and Jeopardizes Our Future (Or, Don't Trust Anyone Under 30). Instead they buy into – and contribute to – what Bauerlein calls “the progressive dumbification of the college curriculum.”

More seriously, she says:

But students today often aren’t very interested in those more traditional offerings, says Mark Bauerlein, an English professor at Emory who wrote The Dumbest Generation: How the Digital Age Stupefies Young Americans and Jeopardizes Our Future (Or, Don't Trust Anyone Under 30). Instead they buy into – and contribute to – what Bauerlein calls “the progressive dumbification of the college curriculum.”

Link to very nice interactive graph on employment

MISH's Global Economic Trend Analysis (click here) has a really nice interactive graph on "Employment History Since 2001 by Job Type." It is worth investigating.

Bottom line according to MISH:

When it comes to jobs, this is the weakest recovery ever except for health-care.

Bottom line according to MISH:

When it comes to jobs, this is the weakest recovery ever except for health-care.

What this recession has done to employment

I still encounter people who think this recession "hasn't been that bad" and that the "media" are simply over-reporting it. Well, the blog CalculatedRISK has a graph (click on "Graph Galleries" at the top of the page) that provides us with a pretty clear picture of what has happened to unemployment in this recession. Here's the graph (click on it to enlarge it). The graph shows the percent of job losses relative to the peak employment month vs. the number of months since peak employment for the recessions that have occurred since WWII. Yes, the red line is the current recession. I'm not sure how you could "over-report" this.

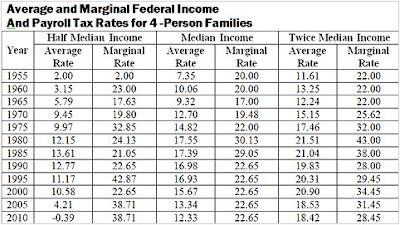

Bruce Barlett on tax rates (again)

Bruce Bartlett has another very interesting piece today over at Economix that is a follow up to an earlier piece about historical tax rates. He consistently cuts through the rhetoric (and political games) about taxes and is always worth reading. Today's piece looks at marginal tax rates. Below is the key table from his post (the data are from the Treasury Department and the Tax Policy Center).

As Mr. Bartlett says,

As one can see, average tax rates on the working poor have never been lower; in fact, they pay neither income taxes nor the employee’s share of the payroll tax, because the earned income tax credit offsets both and even gives them a small refund on top.

However, the tax credit is phased out at a rate of 21.06 percent for families with two children after their earned income reaches $16,690. The loss of a refundable credit is exactly the same, economically, as paying more taxes, and this is what imposes such high marginal rates on the working poor.

A typical middle-class family, on the other hand, is paying less in federal taxes than it has since 1967. Its marginal rate is also down substantially since it peaked in 1982 at 31.7 percent. The well-to-do family, too, has seen its average and marginal tax rates decline substantially.

As Mr. Bartlett says,

As one can see, average tax rates on the working poor have never been lower; in fact, they pay neither income taxes nor the employee’s share of the payroll tax, because the earned income tax credit offsets both and even gives them a small refund on top.

However, the tax credit is phased out at a rate of 21.06 percent for families with two children after their earned income reaches $16,690. The loss of a refundable credit is exactly the same, economically, as paying more taxes, and this is what imposes such high marginal rates on the working poor.

A typical middle-class family, on the other hand, is paying less in federal taxes than it has since 1967. Its marginal rate is also down substantially since it peaked in 1982 at 31.7 percent. The well-to-do family, too, has seen its average and marginal tax rates decline substantially.

Alan Blinder on government spending and jobs

Alan Blinder (professor of economics and public affairs at Princeton) has a timely (in my opinion) piece in the Wall Street Journal today in which he takes on the claim that seems to surface almost everywhere these days that government spending is a "job killer." We have people running for office here in Mississippi making this claim currently.

I confess that I am puzzled on two fronts: (1) that people keep making this claim without any supporting facts, and (2) that it hasn't been confronted more aggressively. As Mr. Blinder says,

It is easy, but irrelevant, to understand how someone might object to any particular item in the federal budget—whether it is the war in Afghanistan, ethanol subsidies, Social Security benefits, or building bridges to nowhere. But even building bridges to nowhere would create jobs, not destroy them, as the congressman from nowhere knows. To be sure, that is not a valid argument for building them. Dumb public spending deserves to be rejected—but not because it kills jobs.

Again, I'm not making an argument for government spending in general. The concern that has arisen over the national debt is appropriate (if often only motivated by political agendas) and placing our nation on a more sustainable path of spending is a good thing. Again, professor Blinder:

In sum, you may view any particular public-spending program as wasteful, inefficient, leading to "big government" or objectionable on some other grounds. But if it's not financed with higher taxes, and if it doesn't drive up interest rates, it's hard to see how it can destroy jobs.

Once again, we need to ask people who are making the claims to "show us the data." I am perplexed that candidates (and sitting officials) can go unchallenged while making very dubious claims. A strong democracy demands more of us than this.

I confess that I am puzzled on two fronts: (1) that people keep making this claim without any supporting facts, and (2) that it hasn't been confronted more aggressively. As Mr. Blinder says,

It is easy, but irrelevant, to understand how someone might object to any particular item in the federal budget—whether it is the war in Afghanistan, ethanol subsidies, Social Security benefits, or building bridges to nowhere. But even building bridges to nowhere would create jobs, not destroy them, as the congressman from nowhere knows. To be sure, that is not a valid argument for building them. Dumb public spending deserves to be rejected—but not because it kills jobs.

Again, I'm not making an argument for government spending in general. The concern that has arisen over the national debt is appropriate (if often only motivated by political agendas) and placing our nation on a more sustainable path of spending is a good thing. Again, professor Blinder:

In sum, you may view any particular public-spending program as wasteful, inefficient, leading to "big government" or objectionable on some other grounds. But if it's not financed with higher taxes, and if it doesn't drive up interest rates, it's hard to see how it can destroy jobs.

Once again, we need to ask people who are making the claims to "show us the data." I am perplexed that candidates (and sitting officials) can go unchallenged while making very dubious claims. A strong democracy demands more of us than this.

Monday, June 20, 2011

The economic value of a bachelor's degree

The Chronicle of Higher Education has a very interesting interactive graph displaying the "median earnings by major and subject area." The basic graph (not interactive) is given below (you will need to click on it to enlarge it).

It is pretty neat and certainly interesting. If you go to the link, you can see much more detail within the groups

As a person strongly interested in data, I'm always drawn to this kind of information. However, I also inevitably end up asking myself this question: Do students research the economic implications of their choice of college major? I don't know. I would like to see some good research on this.

It is pretty neat and certainly interesting. If you go to the link, you can see much more detail within the groups

As a person strongly interested in data, I'm always drawn to this kind of information. However, I also inevitably end up asking myself this question: Do students research the economic implications of their choice of college major? I don't know. I would like to see some good research on this.

The challenge of declining worker incomes

David Frum has a post over at his web site (FrumForum) about the declining share of worker incomes. He uses the following graph from the St. Louis Fed to illustrate this (click on it to enlarge).

Mr. Frum then poses the following two questions for "Republican presidential candidates" (Frum is a Republican):

1. Is this a problem?

2. If yes, what can be done about it?

I think these questions should be posed to every candidate (regardless of party). In fact, I would like to hear some state governors answer these questions.

The recent "skirmishes" in Wisconsin indicate that many people do not see unions as part of the answer. OK. But what is? The data consistently show that the "working class" has not benefited economically nearly to the degree that the top 25% have over the past three decades. While income disparity may be inevitable to some degree in capitalism (see previous posts on this), it surely can become so large that it is untenable. I recently had lunch with a well-known economist who is a live-long Republican and served in some Republican administrations. I asked him what concerns him about the national economy. Of course, he mentioned the growing debt burden, but his second issue was growing income disparity. This shouldn't be a partisan issue.

Mr. Frum then poses the following two questions for "Republican presidential candidates" (Frum is a Republican):

1. Is this a problem?

2. If yes, what can be done about it?

I think these questions should be posed to every candidate (regardless of party). In fact, I would like to hear some state governors answer these questions.

The recent "skirmishes" in Wisconsin indicate that many people do not see unions as part of the answer. OK. But what is? The data consistently show that the "working class" has not benefited economically nearly to the degree that the top 25% have over the past three decades. While income disparity may be inevitable to some degree in capitalism (see previous posts on this), it surely can become so large that it is untenable. I recently had lunch with a well-known economist who is a live-long Republican and served in some Republican administrations. I asked him what concerns him about the national economy. Of course, he mentioned the growing debt burden, but his second issue was growing income disparity. This shouldn't be a partisan issue.

Sunday, June 19, 2011

A disturbing preference for boys

Jonathan Last over at the Wall Street Journal has a review of the book Unnatural Selection: Choosing Boys Over Girls and the Consequences of a World Full of Men by Mara Hvistendahl. The story isn't pretty. According to Mr. Last, Hvistendahl documents that:

In nature, 105 boys are born for every 100 girls. This ratio is biologically ironclad. Between 104 and 106 is the normal range, and that's as far as the natural window goes. Any other number is the result of unnatural events.

Yet today in India there are 112 boys born for every 100 girls. In China, the number is 121—though plenty of Chinese towns are over the 150 mark. China's and India's populations are mammoth enough that their outlying sex ratios have skewed the global average to a biologically impossible 107. But the imbalance is not only in Asia. Azerbaijan stands at 115, Georgia at 118 and Armenia at 120.

What is causing the skewed ratio: abortion. If the male number in the sex ratio is above 106, it means that couples are having abortions when they find out the mother is carrying a girl. By Ms. Hvistendahl's counting, there have been so many sex-selective abortions in the past three decades that 163 million girls, who by biological averages should have been born, are missing from the world.

Mr. Last argues that the book is filled with many important observations, data, and insight, and that it's only shortcoming is the tendency of Ms. Hvistendahl to inject her criticisms of views that differ from her own in a way that detracts from her main points.

This is a subject that is long overdue to be "aired out." I think I will add the book to my Summer reading list.

In nature, 105 boys are born for every 100 girls. This ratio is biologically ironclad. Between 104 and 106 is the normal range, and that's as far as the natural window goes. Any other number is the result of unnatural events.

Yet today in India there are 112 boys born for every 100 girls. In China, the number is 121—though plenty of Chinese towns are over the 150 mark. China's and India's populations are mammoth enough that their outlying sex ratios have skewed the global average to a biologically impossible 107. But the imbalance is not only in Asia. Azerbaijan stands at 115, Georgia at 118 and Armenia at 120.

What is causing the skewed ratio: abortion. If the male number in the sex ratio is above 106, it means that couples are having abortions when they find out the mother is carrying a girl. By Ms. Hvistendahl's counting, there have been so many sex-selective abortions in the past three decades that 163 million girls, who by biological averages should have been born, are missing from the world.

Mr. Last argues that the book is filled with many important observations, data, and insight, and that it's only shortcoming is the tendency of Ms. Hvistendahl to inject her criticisms of views that differ from her own in a way that detracts from her main points.

This is a subject that is long overdue to be "aired out." I think I will add the book to my Summer reading list.

Some salaries for jobs in Mississippi (from PayScale)

Tax cuts and revenue growth

OK - let's bring some data to the muddled discussion about tax cuts (which promises only to become more muddled as the election campaigns get in full battle mode). The latest person to make the claim that "tax cuts pay for themselves" is Gov. Tim Pawlenty (June 13 interview with Slate is here). Bruce Bartlett has a post that does a nice job (written for the Fiscal Times) refuting these claims. Bottom line, the data simply do not support the claim that tax cuts increase revenue. Mr. Pawlenty specifically mentions the administration of President Reagan in support of his view. But as Bruce Barlett points out (and notes that the officials in the Reagan administration never claimed the tax cuts would pay for themselves):

The fact is that the only metric that really matters is revenues as a share of the gross domestic product. By this measure, total federal revenues fell from 19.6 percent of GDP in 1981 to 18.4 percent of GDP by 1989. This suggests that revenues were $66 billion lower in 1989 as a result of Reagan’s policies.

Whether it is Democrats or Republicans, the notion that if you continue to repeat a falsehood long enough, people will simply tire of refuting it and go away is a disturbing strategy.

The fact is that the only metric that really matters is revenues as a share of the gross domestic product. By this measure, total federal revenues fell from 19.6 percent of GDP in 1981 to 18.4 percent of GDP by 1989. This suggests that revenues were $66 billion lower in 1989 as a result of Reagan’s policies.

Whether it is Democrats or Republicans, the notion that if you continue to repeat a falsehood long enough, people will simply tire of refuting it and go away is a disturbing strategy.

Political consensus on health care?

Gregory Mankiw has an opinion piece in the Sunday New York Times in which he argues that, practically speaking, Republicans and Democrats have reached "some agreement" on some of the critical issues involving health care reform. What are these sources of agreement? Well, he says they are:

- the value of competition in health care

- a mandate for health insurance

- the money must come from somewhere (taxes, premiums, ...)

- health care costs can be controlled

Professor Mankiw (economics professor at Harvard and current adviser to Mitt Romney) says neither party seems to have a "Plan B" in case their attempts to control health care costs fail.

Professor Mankiw is, of course, talking about a "consensus" in the sense that the practical consequences of the views converge. However, that seems very different from an "actionable" consensus. I'm just not as optimistic as he is; that is, I don't see a critical mass in either party large enough to persuade them to "come together" and create an actual plan. I hope I'm wrong.

- the value of competition in health care

- a mandate for health insurance

- the money must come from somewhere (taxes, premiums, ...)

- health care costs can be controlled

Professor Mankiw (economics professor at Harvard and current adviser to Mitt Romney) says neither party seems to have a "Plan B" in case their attempts to control health care costs fail.

Professor Mankiw is, of course, talking about a "consensus" in the sense that the practical consequences of the views converge. However, that seems very different from an "actionable" consensus. I'm just not as optimistic as he is; that is, I don't see a critical mass in either party large enough to persuade them to "come together" and create an actual plan. I hope I'm wrong.

Saturday, June 18, 2011

Lawyers, accountants, and ..... money

Mark Everson has an opinion piece over at The New York Times about the growing influence of lawyers and accountants. He makes some interesting observations that are important to keep in mind as we continue to debate the relative paths to sound fiscal health as a nation, particularly tax reform. He says,

Lawyers and accountants who were once the proud pillars of our financial system have become the happy architects of its circumvention. Nowhere is this more the case than in the world of tax law. Companies (and wealthy individuals) pay handsomely for tax professionals not just to find the lines, but to push them ever outward.

Maybe Cyndi Lauper (from her 1998 album "Wanna Have Fun") had it about right many years ago.

Lawyers and accountants who were once the proud pillars of our financial system have become the happy architects of its circumvention. Nowhere is this more the case than in the world of tax law. Companies (and wealthy individuals) pay handsomely for tax professionals not just to find the lines, but to push them ever outward.

Maybe Cyndi Lauper (from her 1998 album "Wanna Have Fun") had it about right many years ago.

Money changes everything

Money, money changes everything

We think we know what we're doin'

That don't mean a thing

It's all in the past now

Money changes everything

Money, money changes everything

We think we know what we're doin'

That don't mean a thing

It's all in the past now

Money changes everything

Income disparity and executive pay

Peter Whoriskey has a very interesting article at The Washington Post about the connection between executive pay and income disparity. The data is striking.

He points out that income disparity in the U.S. has grown along with the increase in executive compensation. Many economists are concerned about this, but there appears to be no clear resolution. In fact, as Mr. Whoriskey points out, it is a common feature of modern capitalist economies.

Inequality, economists have noted, is an essential part of capitalism. At least in theory, “the invisible hand,” or market system, sets compensation levels to lead workers into pursuits that are the most productive to society. This produces inequality but leads to a more efficient economy.

He points out that income disparity in the U.S. has grown along with the increase in executive compensation. Many economists are concerned about this, but there appears to be no clear resolution. In fact, as Mr. Whoriskey points out, it is a common feature of modern capitalist economies.

Inequality, economists have noted, is an essential part of capitalism. At least in theory, “the invisible hand,” or market system, sets compensation levels to lead workers into pursuits that are the most productive to society. This produces inequality but leads to a more efficient economy.

Health care costs and risk

Walt Bodanich and Jo Craven McGinty have an article in the New York Times about the overuse of CT scans. Recent data on the use of CT scans are disturbing. The authors point out that:

Performing two scans in succession is rarely necessary, radiologists say, yet some hospitals were doing that more than 80 percent of the time for their Medicare chest patients, according to Medicare outpatient claims from 2008, the most recent year available.

When the "mammogram controversy" exploded several months ago, much of the debate concerned payment for the mammograms (and the scientists' recommendations were roundly assaulted). It turns out the scientists were mostly correct and they were trying to weigh cost and risk (something too many people ignore). There is a tendency to focus on the probable consequences or risks of "doing nothing" and to forget there are also risks for acting. The article points out that:

Double scans expose patients to extra radiation while heaping millions of dollars in extra costs on an already overburdened Medicare program. A single CT scan of the chest is equal to about 350 standard chest X-rays, so two scans are twice that amount.

Performing two scans in succession is rarely necessary, radiologists say, yet some hospitals were doing that more than 80 percent of the time for their Medicare chest patients, according to Medicare outpatient claims from 2008, the most recent year available.

When the "mammogram controversy" exploded several months ago, much of the debate concerned payment for the mammograms (and the scientists' recommendations were roundly assaulted). It turns out the scientists were mostly correct and they were trying to weigh cost and risk (something too many people ignore). There is a tendency to focus on the probable consequences or risks of "doing nothing" and to forget there are also risks for acting. The article points out that:

Double scans expose patients to extra radiation while heaping millions of dollars in extra costs on an already overburdened Medicare program. A single CT scan of the chest is equal to about 350 standard chest X-rays, so two scans are twice that amount.

David McCullough on our poor knowledge of history

Brian Bolduc at The Wall Street Journal has an interesting interview with David McCullough. Mr. McCullough argues that U. S. students' poor understanding of history can be traced to several causes. At the top of his list is poor teaching. He says:

One problem is personnel. "People who come out of college with a degree in education and not a degree in a subject are severely handicapped in their capacity to teach effectively," Mr. McCullough argues. "Because they're often assigned to teach subjects about which they know little or nothing." The great teachers love what they're teaching, he says, and "you can't love something you don't know anymore than you can love someone you don't know."

One problem is personnel. "People who come out of college with a degree in education and not a degree in a subject are severely handicapped in their capacity to teach effectively," Mr. McCullough argues. "Because they're often assigned to teach subjects about which they know little or nothing." The great teachers love what they're teaching, he says, and "you can't love something you don't know anymore than you can love someone you don't know."

Is Social Security and Medicare worth it?

James Kwak over at The Baseline Scenario has an interesting post that addresses the question: are Social Security and Medicare programs just for the elderly? His answer:

But the problem with this framing is that “the elderly” change every year. There’s nothing inherently wrong or unfair with a program in which you pay insurance premiums while you work and collect benefits when you retire. Saying such a program benefits the elderly is like saying that life insurance doesn’t benefit the insured, only the beneficiaries: it’s true in a trivial sense, but people still want and buy life insurance anyway.

As he says, there is a much more interesting question: Are the programs worth it?

So the real question is whether you would pay 12.4 percent of your wages for roughly 40-45 years in order to get back that distribution of replacement rates for about 20-25 years.

He has an interesting answer that is worth reading.

But the problem with this framing is that “the elderly” change every year. There’s nothing inherently wrong or unfair with a program in which you pay insurance premiums while you work and collect benefits when you retire. Saying such a program benefits the elderly is like saying that life insurance doesn’t benefit the insured, only the beneficiaries: it’s true in a trivial sense, but people still want and buy life insurance anyway.

As he says, there is a much more interesting question: Are the programs worth it?

So the real question is whether you would pay 12.4 percent of your wages for roughly 40-45 years in order to get back that distribution of replacement rates for about 20-25 years.

He has an interesting answer that is worth reading.

Friday, June 17, 2011

Good data and the role of reason

Obviously, one of the themes of my blog is the importance of good data. In May I was in Oakland, California and there were billboards everywhere about the impending end of the world (Harold Camping has offices there). I was taken by the fact that a person with such unsubstantiated views could garner enough followers and funding for these displays, and I found myself thinking about what constitutes evidence and rationality. Well, I wasn't the only one. Over at Opinionator, the philosopher Gary Cutting (Notre Dame) has posted a piece about this very issue ("Epistemology and the End of the World"). He writes,

What was most disturbing about Camping was his claim to be certain that the rapture would occur on May 21. Perhaps he had a subjective feeling of certainty about his prediction, but he had no good reasons to think that this feeling was reliable. Similarly, you may feel certain that you will get the job, but this does not make it (objectively) certain that you will. For that you need reasons that justify your feeling.

It seems that people almost think you rude today if you ask for evidence, for data. In an age when there is a preoccupation with what Plato called "mere opinion," expecting some evidence and a valid argument from someone is viewed as almost snobbish. Mr. Cutting concludes his piece as follows:

The case against Camping was this: His subjective certainty about the rapture required objectively good reasons to expect its occurrence; he provided no such reasons, so his claim was not worthy of belief. Christians who believe in a temporally unspecified rapture agree with this argument. But the same argument undermines their own belief in the rapture. It’s not just that “no one knows the day and hour” of the rapture. No one knows that it is going to happen at all.

What was most disturbing about Camping was his claim to be certain that the rapture would occur on May 21. Perhaps he had a subjective feeling of certainty about his prediction, but he had no good reasons to think that this feeling was reliable. Similarly, you may feel certain that you will get the job, but this does not make it (objectively) certain that you will. For that you need reasons that justify your feeling.

It seems that people almost think you rude today if you ask for evidence, for data. In an age when there is a preoccupation with what Plato called "mere opinion," expecting some evidence and a valid argument from someone is viewed as almost snobbish. Mr. Cutting concludes his piece as follows:

The case against Camping was this: His subjective certainty about the rapture required objectively good reasons to expect its occurrence; he provided no such reasons, so his claim was not worthy of belief. Christians who believe in a temporally unspecified rapture agree with this argument. But the same argument undermines their own belief in the rapture. It’s not just that “no one knows the day and hour” of the rapture. No one knows that it is going to happen at all.

Life expectancy in Mississippi

A new study ("Falling behind: life expectancy in US counties from 2000 to 2007 in an international context," was published June 15, 2011 in BioMed Central’s open-access journal Population Health Metrics) examines the life expectancy of all counties in the U. S. and includes some international comparisons. Unfortunately, Mississippi figures negatively in the study as follows.

Five counties in Mississippi have the lowest life expectancies for women, all below 74.5 years, putting them behind nations such as Honduras, El Salvador, and Peru. Four of those counties, along with Humphreys County, MS, have the lowest life expectancies for men, all below 67 years, meaning they are behind Brazil, Latvia, and the Philippines.

The data for the study can be downloaded and below I show the ten counties for males and females with the lowest life expectancy (in years for 2007) in Mississippi. The average life expectancy in 2007 was 70.9 years for males and 77.9 for females.

Five counties in Mississippi have the lowest life expectancies for women, all below 74.5 years, putting them behind nations such as Honduras, El Salvador, and Peru. Four of those counties, along with Humphreys County, MS, have the lowest life expectancies for men, all below 67 years, meaning they are behind Brazil, Latvia, and the Philippines.

The data for the study can be downloaded and below I show the ten counties for males and females with the lowest life expectancy (in years for 2007) in Mississippi. The average life expectancy in 2007 was 70.9 years for males and 77.9 for females.

"Saving Social Security"

The Wall Street Journal has an interactive feature whereby you can choose how you would address the challenges of funding Social Security. There are several options and you can see the impact of each option. The Journal states that,

Social Security actuaries estimate that the current payroll tax of 12.4% (divided evenly between employers and employees) plus income taxes paid by beneficiaries will not raise enough money to fully cover all of the benefits that have been promised over the next 75 years. Specifically, they put the gap at 2.22% of taxable earnings. Put another way, the payroll tax could be boosted by about 2.22 percentage points, or benefits could be cut by an equivalent amount, to close the gap.

(click on the graph to enlarge) It is interesting to see what impact different options have.

Social Security actuaries estimate that the current payroll tax of 12.4% (divided evenly between employers and employees) plus income taxes paid by beneficiaries will not raise enough money to fully cover all of the benefits that have been promised over the next 75 years. Specifically, they put the gap at 2.22% of taxable earnings. Put another way, the payroll tax could be boosted by about 2.22 percentage points, or benefits could be cut by an equivalent amount, to close the gap.

(click on the graph to enlarge) It is interesting to see what impact different options have.

Mississippi universities increasingly depend on tuition

Elizabeth Crisp over at the Clarion Ledger reports that Mississippi universities are increasingly dependent on tuition dollars (and less so on state tax dollars). She says,

More than 57 percent of general funds for the fiscal year that begins July 1 will come from tuition, while 37 percent will come from state appropriations, according to budgets approved Thursday.

She quotes Hank Bounds (Higher Education Commissioner) who says that ten years ago 54% of the funding came from the state.

More than 57 percent of general funds for the fiscal year that begins July 1 will come from tuition, while 37 percent will come from state appropriations, according to budgets approved Thursday.

She quotes Hank Bounds (Higher Education Commissioner) who says that ten years ago 54% of the funding came from the state.

"The Economics of Enough"

David Leonhardt over at Economix has posted an interview with Diane Coyle (a British economist) about her new book The Economics of Enough. The book focuses "how to make sure what we achieve in the present doesn't come at the expense of the future." The book argues that we lack the politics of enough.

A second reason we lack the “politics of enough” is that people are unlikely to make sacrifices for the future if the future looks likely to be as unfair as the present. The decline in the real incomes of millions of families, especially in the U.S., while the very rich have grown much richer make it unlikely that a majority of voters would have any confidence about benefiting from future growth.

It sounds like a very interesting book and I have placed it on my Summer reading list.

A second reason we lack the “politics of enough” is that people are unlikely to make sacrifices for the future if the future looks likely to be as unfair as the present. The decline in the real incomes of millions of families, especially in the U.S., while the very rich have grown much richer make it unlikely that a majority of voters would have any confidence about benefiting from future growth.

It sounds like a very interesting book and I have placed it on my Summer reading list.

The complex issue of local farming

Mark Thoma at Economist's View points us to an article by Edward Glaeser in the Boston Globe about "urban farming." The "buy local" movement has contributed significantly to the growth of urban farming. Glaeser acknowledges that urban farming has many positive characteristics (for example, the educational value). But Glaeser makes a clear assertion:

There are many good reasons to like local food, but any large-scale metropolitan farming will do more harm than good to the environment. Devoting scarce metropolitan land to agriculture means lower density levels, longer drives, and carbon emission increases which easily offset the modest greenhouse gas reductions associated with shipping less food.

His article reviews some research on the potential impact of urban farming and concludes that:

We must weigh the environmental benefits from shipping less food against the environmental costs of producing and storing local food in a state that doesn’t exactly have ideal conditions for every kind of produce.

There are many good reasons to like local food, but any large-scale metropolitan farming will do more harm than good to the environment. Devoting scarce metropolitan land to agriculture means lower density levels, longer drives, and carbon emission increases which easily offset the modest greenhouse gas reductions associated with shipping less food.

His article reviews some research on the potential impact of urban farming and concludes that:

We must weigh the environmental benefits from shipping less food against the environmental costs of producing and storing local food in a state that doesn’t exactly have ideal conditions for every kind of produce.

Thursday, June 16, 2011

"Freedom" rankings

The Mercatus Center (a Libertarian oriented think tank at George Mason University) has published a report ranking the states by "their public policies that affect individual freedom in the economic, social, and personal spheres." It is often hard to know what to make of these kinds of reports (there is always an agenda at work). But - for whatever it is worth - the report ranks Mississippi as follows:

Fiscal Policy Ranked 23rd

Regulatory Policy Ranked 30th

Economic Freedom Ranked 30th

Personal Freedom Ranked 12th

Overall Freedom Ranked 24th

The Citizens for Tax Justice has a post that critiques some aspects of the report.

Fiscal Policy Ranked 23rd

Regulatory Policy Ranked 30th

Economic Freedom Ranked 30th

Personal Freedom Ranked 12th

Overall Freedom Ranked 24th

The Citizens for Tax Justice has a post that critiques some aspects of the report.

The confusing medicare funding debate

Jared Bernstein has an informative post about the argument over Medicare. He refers to an interesting analysis by the Center on Budget and Policy Priorities (see chart below) that indicates how much variation exists in the Medicare Trustee reports. My question: Why can't we have an actuarial assessment (that recognizes the unknowns) apart from the political bantering?

Tuesday, June 14, 2011

Mississippi taxes as a percent of personal income

Sara Miller of the Mississippi Economic Policy Center has some interesting data on her blog regarding Mississippi taxes as a percent of personal income. Using data from the Institute on Taxation and Economic Policy, she generates the following graph. The data is for 2007. She points out that while Mississippi ranks 46th in taxes per capita, it is 27th in taxes collected as a percent of personal income.

National Assessment of Educational Progress (NAEP) history results

The National Assessment of Educational Progress released the results for its history assessments for 2010. Like most national assessments, there was good news and bad news. Some good news: test scores improved for all grades from 1994 results. The bad news: less than 25% of students performed at the proficient level. Below are some summary graphs from the report.

Cutting government spending

Tyler Cowen (MarginalRevolution blog) has a good post on specific things that can be done to cut government spending. It is worth a look. His main theme: cut the rate of growth of spending on health care. He lists some very reasonable suggestions.

Keeping Doctors in Mississippi

Elizabeth Crisp has a post (Clarion Ledger) about the Rural Physician Scholars Program which intends to keep medical students in Mississippi (rural areas with need) when they complete medical school at the University Medical Center in Jackson (UMC).

The problems of healthcare are so complex and multidimensional that it requires several points of attack. Though small, these programs are encouraging.

The problems of healthcare are so complex and multidimensional that it requires several points of attack. Though small, these programs are encouraging.

David Brooks sounds off on the upcoming election

David Brooks has an essay in the New York Times in which he takes both parties to task regarding the upcoming election. He says,

... the two parties contesting this election are unusually pathetic. Their programs are unusually unimaginative. Their policies are unusually incommensurate to the problem at hand.

He continues with a a list of some of the issues that just aren't receiving enough attention from either party.

The number of business start-ups per capita has been falling steadily for the past three decades. Workers’ share of national income has been declining since 1983. Male wages have been stagnant for about 40 years. The American working class — those without a college degree — is being decimated, economically and socially. In 1960, for example, 83 percent of those in the working class were married. Now only 48 percent are.

His essay contains a pretty thorough routing of both parties and is worth a read.

... the two parties contesting this election are unusually pathetic. Their programs are unusually unimaginative. Their policies are unusually incommensurate to the problem at hand.

He continues with a a list of some of the issues that just aren't receiving enough attention from either party.

The number of business start-ups per capita has been falling steadily for the past three decades. Workers’ share of national income has been declining since 1983. Male wages have been stagnant for about 40 years. The American working class — those without a college degree — is being decimated, economically and socially. In 1960, for example, 83 percent of those in the working class were married. Now only 48 percent are.

His essay contains a pretty thorough routing of both parties and is worth a read.

Retirement plans after the recession

Kelly Greene of the Wall Street Journal is reporting in today's paper that companies that cut matching contributions to their 401(k) plans during the recession are beginning to restore them. However, many companies are including some changes as they restore contributions. The article states that:

But a number of firms are contributing less than before, are linking contributions to profits or are making workers save more on their own before kicking in, say benefits consultants.

But a number of firms are contributing less than before, are linking contributions to profits or are making workers save more on their own before kicking in, say benefits consultants.

Index of Small Business Optimism declines for third straight month

The National Federation of Independent Business (NFIB) has a new report that shows the Index of Small Business Optimism fell again in May (it has now declined for three straight months - see graph below). The report says that small businesses (about 25%) are still reporting weak sales as their top business challenge. Approximately 51% of businesses in the State of Mississippi are very small (four employees or less).

Monday, June 13, 2011

China's automobile growth

James Hamilton (Econbrowser) points us to a very interesting analysis by Stuart Staniford (Early Warning) of the growth of the number of vehicles on China's highways. He has a very sobering graph (see below). Gas prices.....

The slow recovery continues

Justin Lahart reports in the Wall Street Journal this morning that most economists do not expect a "double-dip recession," but their resolve isn't particularly strong. The U. S. economy continues to recover but very slowly. As the graph from the article below shows, job growth continues to be very weak.

Regions Financial Corp. investigating loan reporting by executives

The Wall Street Journal is reporting this morning that Regions Board is investigating the reporting of loans by its executives. This is related to the charges brought against Regions by the Securities and Exchange Commission back in 2010. The Journal reports that,

Regions hasn't reported an annual profit since 2007, and it still hasn't received regulatory approval to pay back $3.5 billion in public support from the Treasury Department's Troubled Asset Relief Program, unlike other banks of similar size.

Regions hasn't reported an annual profit since 2007, and it still hasn't received regulatory approval to pay back $3.5 billion in public support from the Treasury Department's Troubled Asset Relief Program, unlike other banks of similar size.

What isn't being discussed about economic growth?

In my previous post I asked why we can't get our elected politicians (and those aspiring to be elected) to present a coherent story of how the U. S. economy can recover from the Great Recession. Of course, it would be a fair question for someone to ask me what that story might sound like. Fortunately, Bruce Bartlett has a very timely essay on the issue of economic growth (June 10). Mr. Bartlett (a lifelong Republican who served as an adviser to President Ronald Reagan and a Treasury official under President George H. W. Bush) begins his essay as follows:

The essay continues by reviewing some of the basic things about economic growth that economists have learned (even if political parties haven't). For example, economic growth is primarily a function of productivity (which is driven by capital - physical and human, the availability of natural resources, and technological innovation). Interestingly, as Bartlett points out, taxes aren't in that list. As he says,

What is holding back business investment is not taxes, but poor economic prospects. For some time, members of the National Federation of Independent Business have listed “poor sales” as their number one problem. Businesses are not going to invest, no matter how low the tax rate is, if there is no demand for their output.

The essay proceeds to point out that the Republican argument that taxes are the primary driver of economic improvement just isn't supported by the data. Now, lest you jump to conclusions here, the Democrats appear no more enlightened here. By the way, there are people in both parties who understand this, but for whatever reasons, they can't get any traction within their own parties.

So I strongly encourage you to read Mr. Bartlett's essay and to begin asking your local, state, and national leaders to "show you the data" when they put forth their claims about how to improve the U. S. economy. You might be surprised at how little response you get; and that should tell you much about the quality of their opinions.

Sunday, June 12, 2011

What does "It's the economy stupid!" really mean?

It comes as no surprise, of course, that as we actively enter the election season there is bound to be a growing number of "explanations" for the current economic conditions. Thus we have Gingrich calling it "Obama's depression" and White House spokespeople passing up no opportunity to remind voters they "inherited" the economic mess. So what is a conscientious citizen to do?

Well, we could do worse than start with Robert Shiller's essay in today's New York Times. As Professor Shiller says it,

THE origins of the current economic crisis can be traced to a particular kind of social epidemic: a speculative bubble that generated pervasive optimism and complacency. That epidemic has run its course. But we are now living with the malaise it caused.

So, who do we blame for the "social epidemic?" Now, I'm certainly not saying that there were no culprits or that nobody was (and is) to blame. Some very good books and papers have been written that do an admirable job of exploring the causes of the economic recession. Again, Professor Shiller.

Consider this: Home prices rose nearly 10 percent a year on average in the United States from 1997 to 2006, long enough for many people to become accustomed to the pace and to view it as normal. The conventional 30-year fixed mortgage rate averaged 6.8 percent over those years, far below the appreciation rate on housing, so even if you had a substantial mortgage, you were becoming wealthier by the day, at least on paper. People who owned a home over that period had reason to feel pretty well off and proud of their investment acumen. That fed a contagion of optimism and helped to drive the speculative bubble, propelling the economy and the stock market in a feedback loop that repeated year after year.

So, maybe its time we expected our elected officials and potential presidential candidates to put forth a coherent story of "where we go from here" instead of simply playing "sound bite gottcha" with the news cycle. One can hope.

Well, we could do worse than start with Robert Shiller's essay in today's New York Times. As Professor Shiller says it,

THE origins of the current economic crisis can be traced to a particular kind of social epidemic: a speculative bubble that generated pervasive optimism and complacency. That epidemic has run its course. But we are now living with the malaise it caused.

So, who do we blame for the "social epidemic?" Now, I'm certainly not saying that there were no culprits or that nobody was (and is) to blame. Some very good books and papers have been written that do an admirable job of exploring the causes of the economic recession. Again, Professor Shiller.

Consider this: Home prices rose nearly 10 percent a year on average in the United States from 1997 to 2006, long enough for many people to become accustomed to the pace and to view it as normal. The conventional 30-year fixed mortgage rate averaged 6.8 percent over those years, far below the appreciation rate on housing, so even if you had a substantial mortgage, you were becoming wealthier by the day, at least on paper. People who owned a home over that period had reason to feel pretty well off and proud of their investment acumen. That fed a contagion of optimism and helped to drive the speculative bubble, propelling the economy and the stock market in a feedback loop that repeated year after year.

So, maybe its time we expected our elected officials and potential presidential candidates to put forth a coherent story of "where we go from here" instead of simply playing "sound bite gottcha" with the news cycle. One can hope.

Saturday, June 11, 2011

Why do Republicans oppose Elizabeth Warren?

Joe Nocera has a good essay in the New York Times about opposition to Elizabeth Warren as head of the CFPB. After one of the most severe financial meltdowns in U. S. history, it continues to be puzzling to me (yes, I understand the lobbying) that we cannot get better oversight of the financial sector. Nocera puts it well.

You would think that Republicans would like this sort of thing. Instead, they portray Warren as a polarizing ideologue bent on creating an agency that, as Mitch McConnell, the Senate minority leader, put it recently, “could be a serious threat to our financial system.” How, precisely, an agency that tries to keep financial consumers from being gouged threatens the system is something no one ever explains. (Unless, of course, gouging consumers is central to bank profitability. Hmmm...)

So what's the deal? The data that has emerged from the financial crisis seems to clearly indicate the need for better oversight of financial products. So why the opposition?

You would think that Republicans would like this sort of thing. Instead, they portray Warren as a polarizing ideologue bent on creating an agency that, as Mitch McConnell, the Senate minority leader, put it recently, “could be a serious threat to our financial system.” How, precisely, an agency that tries to keep financial consumers from being gouged threatens the system is something no one ever explains. (Unless, of course, gouging consumers is central to bank profitability. Hmmm...)

So what's the deal? The data that has emerged from the financial crisis seems to clearly indicate the need for better oversight of financial products. So why the opposition?

Subscribe to: