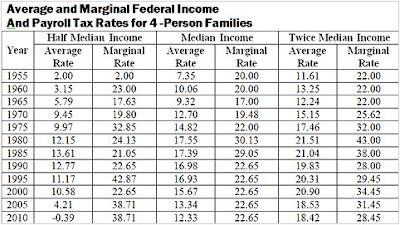

Bruce Bartlett has another very interesting piece today over at Economix that is a follow up to an earlier piece about historical tax rates. He consistently cuts through the rhetoric (and political games) about taxes and is always worth reading. Today's piece looks at marginal tax rates. Below is the key table from his post (the data are from the Treasury Department and the Tax Policy Center).

As Mr. Bartlett says,

As one can see, average tax rates on the working poor have never been lower; in fact, they pay neither income taxes nor the employee’s share of the payroll tax, because the earned income tax credit offsets both and even gives them a small refund on top.

However, the tax credit is phased out at a rate of 21.06 percent for families with two children after their earned income reaches $16,690. The loss of a refundable credit is exactly the same, economically, as paying more taxes, and this is what imposes such high marginal rates on the working poor.

A typical middle-class family, on the other hand, is paying less in federal taxes than it has since 1967. Its marginal rate is also down substantially since it peaked in 1982 at 31.7 percent. The well-to-do family, too, has seen its average and marginal tax rates decline substantially.

No comments:

Post a Comment